Select any Startup on the website and you will see a list of the VCs for it

Calculation of investment attractiveness

The AI-based predictive investment algorithm Parsers VC calculates the investment attractiveness (IA) of startups based on 26 parameters. The investment attractiveness of a startup is calculated for each VC separately. AI determines the requirements of the venture fund and calculates the IA values of startups in the portfolio, then we determine the threshold (median) value for all venture funds. Based on this value, we select the best venture capital funds whose investment focus is on a startup.

The algorithm calculates such parameters as:

- startup stage

- location,

- categories,

- biography of the founders,

- size of funding rounds,

- mentions in the press,

- number of users etc.

The quality of the selection of VCs directly depends on the quality of filling out the startup profile. In well-filled startup profiles, we predict about 90% of rounds.

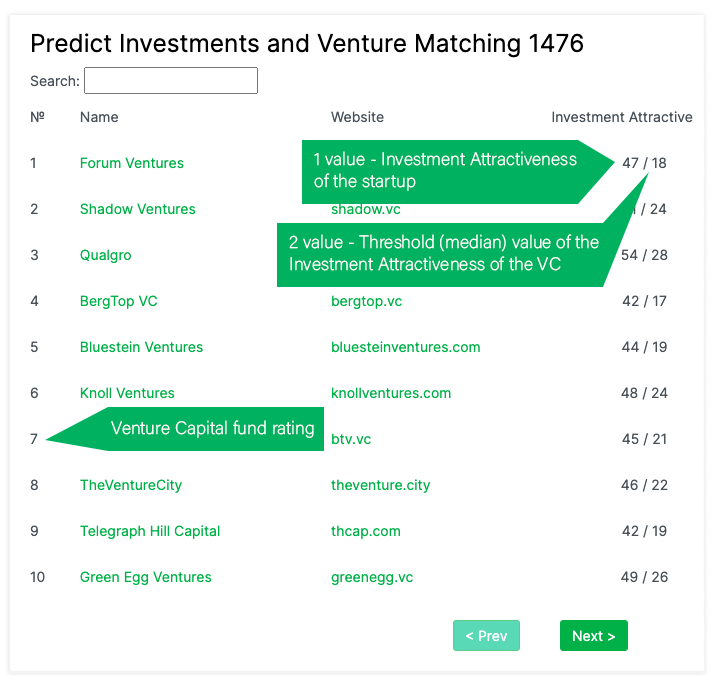

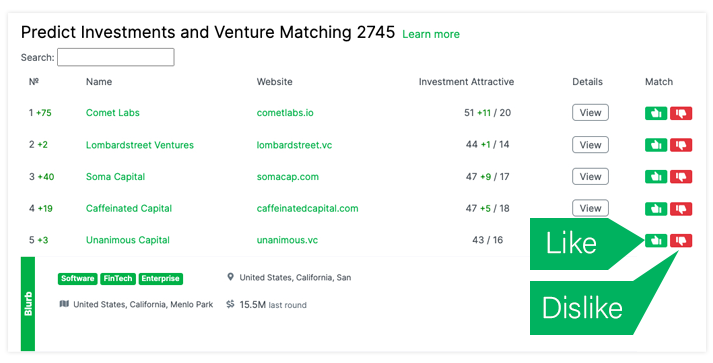

Values in the Table of Predictive Investments for Startups

- 1 value in the table of Predictive Investments -> Investment Attractiveness indicates the Investment Attractiveness of the Startup for this VC.

- 2 value in the table indicates the average value of the investment attractiveness of startups in the portfolio of this VC.

Rating of VCs based on investment attractiveness

The rating of venture capital funds is calculated separately for each startup based on the difference between the investment attractiveness of the startup and the threshold value of the fund.

In the table search, you can find the VC rating for a particular startup. If a VC is not in the search, then this means that the threshold value of the investment attractiveness of a venture fund is higher than the investment attractiveness of a startup or it is not in the database.

Adding/Editing a Startup

Predictive investments for a startup are calculated based on the data in the startup profile. So for a better selection of venture capital funds, update or add information about the startup. You need SingUp with a startup domain email or add it to an existing one in order to have editing access. You can add a startup if it is not in the database, just click Add company, enter the website of the startup and our algorithm will collect information about the startup on the web. Next, check and add information if something is missing.

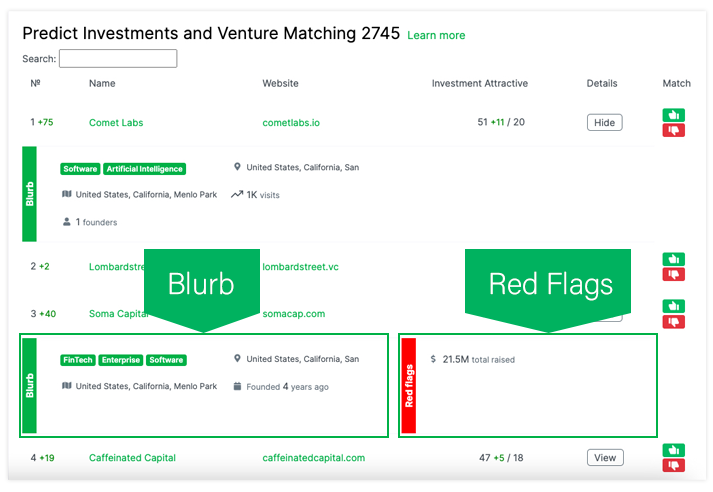

Blurb/Red flags

Blurb is a short summary about this startup, which shows the main metrics that may be of interest to this venture capital fund. The parameters are shown based on the investment focus of the venture fund. Also shown are red flags parameters that may not be suitable for a venture fund based on previous investments.

Venture Matching (Tinder for Venture Capital)

We have made a simple and accurate way to get a funding round. We have selected the best venture capital funds for you in the Predictive Investments table. You only need to click Like for those venture funds that you are interested in. If the venture fund team also likes your startup, then we will make an intro by email. You can send a pitch deck, additional information about the startup, or schedule a call.

All Likes are absolutely confidential and are not visible to anyone until the venture fund likes you back.

Reinforcement learning (RL)

Reinforcement learning allows you to improve the algorithm of Predictive Investments. Each Like and Dislike improves the selection of venture capital fund for a particular startup. The more VCs you like and dislike, the better we predict investments.