Select any Venture Capital fund on the website and you will see a list of the best startups for it

Calculation of Investment Attractiveness

AI-based predictive investment algorithm Parsers VС calculates the investment attractiveness (IA) of startups based on 26 parameters. The investment attractiveness of a startup is calculated for each venture fund separately. AI determines the requirements of the venture fund and calculates the IA values of startups in the portfolio, then we determine the threshold (median) value for all venture funds. Based on this value, we select the best startups to invest in for each VC.

The algorithm calculates such parameters as:

- startup stage

- location,

- categories,

- biography of the founders,

- size of funding rounds,

- mentions in the press,

- number of users, etc.

The quality of selection of startups for VCs directly depends on the quality of filling in the profile of a VC. In well-filled VC fund profiles, we predict about 90% of rounds.

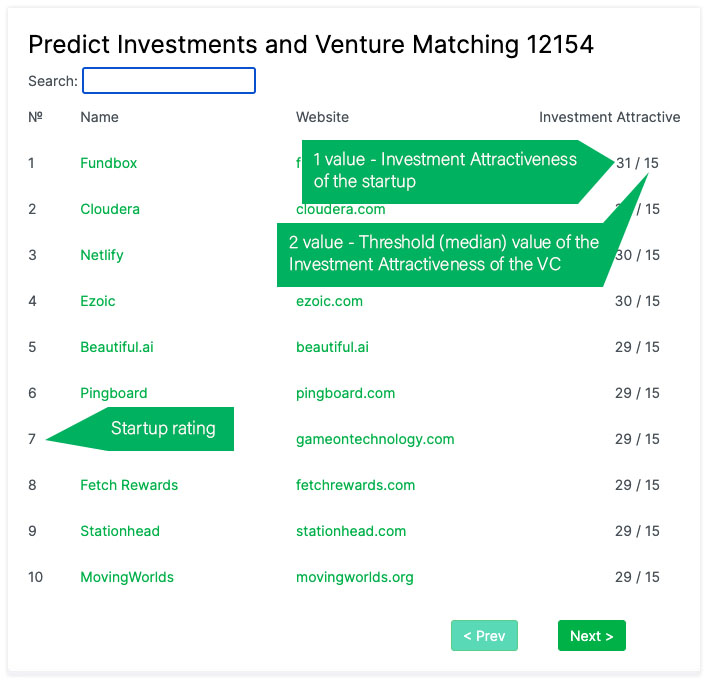

Values in the Table of Predictive Investments for Venture Funds

- 1 value in the table of Predictive Investments -> Investment Attractiveness indicates the Investment Attractiveness of the startup for this venture fund.

- 2 value in the table indicates the threshold (median) value of the investment attractiveness of startups in the portfolio of this venture fund.

Rating of startups based on Investment Attractiveness

The startup rating is calculated separately for each venture fund based on the difference between the investment attractiveness of a startup and the threshold value of the VC.

In the table search, you can find the startup rating for a particular venture fund. If a startup is not in the search, then this means that the investment attractiveness of a startup is below the threshold value for a venture fund or it is not in the database.

Adding/Editing a Venture Capital fund

Predictive Investments for a venture fund are calculated based on the data in the VC profile. So for a better selection of startups, update or add information about the venture fund and funding rounds. You need SingUp with a venture fund domain email or add it to an existing one in order to be able to edit it. You can add a venture fund if it is not in the database, just click Add company, enter the website of the venture fund and our algorithm will collect information about the VC on the web. Next, check and add information if something is missing.

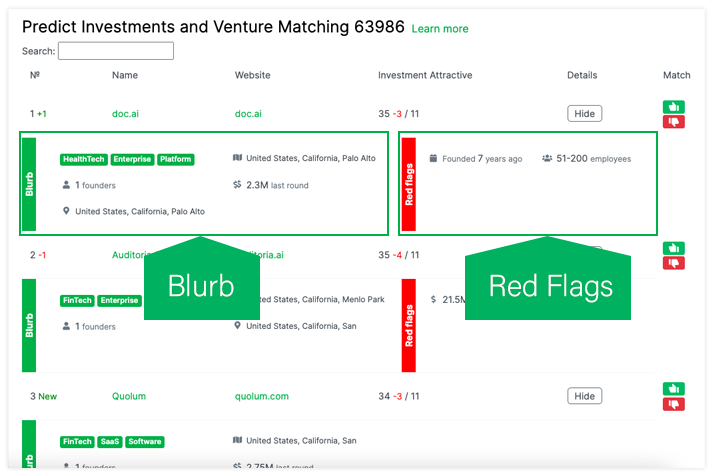

Blurb/Red flags

Blurb is a short summary of a startup that shows the main metrics that may be of interest to this venture capital fund. The parameters are shown based on the investment focus of the venture fund. Also shown are red flags parameters that may not be suitable for a venture fund based on previous investments. You can see the Blurb and Red flags by clicking Veiw in the Details column.

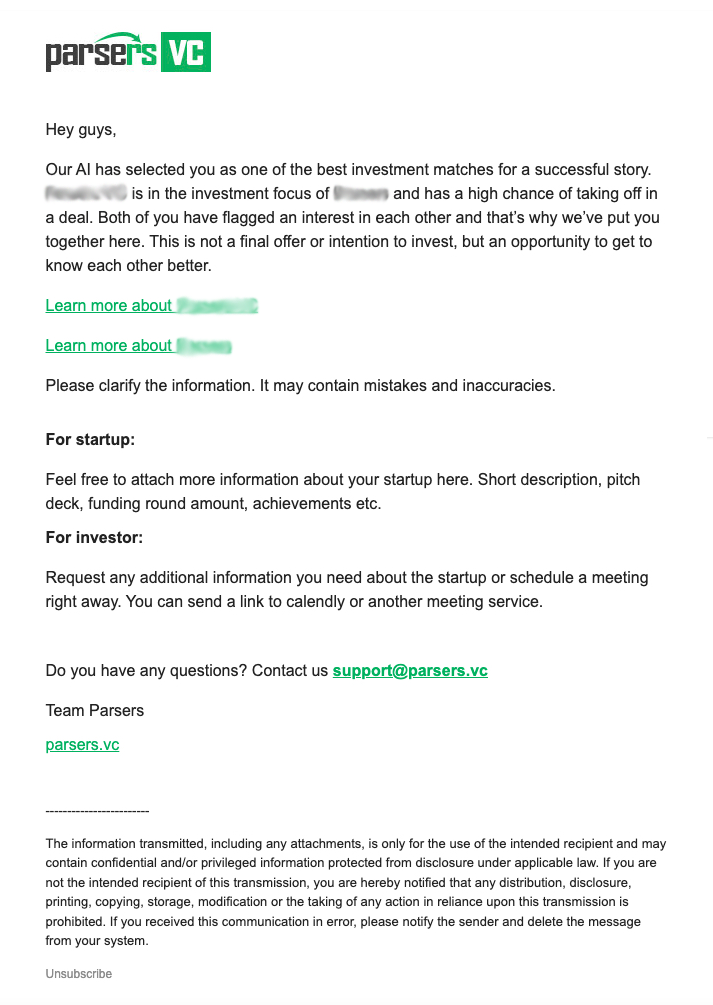

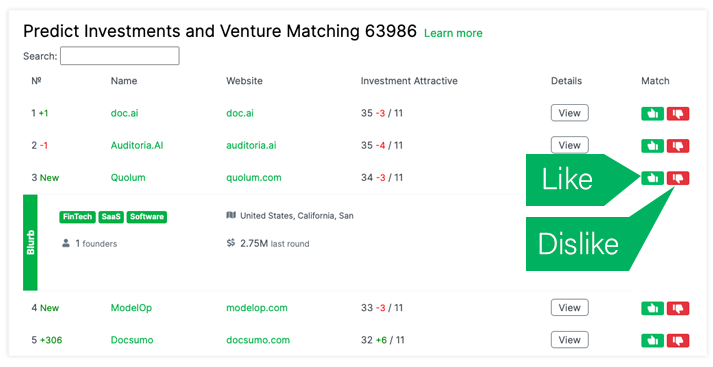

Venture Matching (Tinder for Venture Capital)

We have made a simple and accurate way to get a stream of startups into your pipeline. We have selected for you the best startups to invest in the Predictive Investments table. You only need to click Like for those startups that you are interested in. If the startup founder also Like your venture fund, then we will make an intro by email. You can request a pitch deck, more information about a startup, schedule a call etc.

All Likes are absolutely confidential and are not visible to anyone until the startup likes you back.

Reinforcement learning (RL)

Reinforcement learning allows you to improve the algorithm of Predictive Investments. Each Like and Dislike improves the selection of startups for a particular venture fund. The more startups you like and dislike, the better we predict investments.