The Vodacom-Maziv Merger: A Clash of Titans in South Africa's Telecom Landscape

June 28, 2025, 10:11 pm

Global Partnership for Ethiopia

Location: Portugal, Lisbon, Cascais

Employees: 5001-10000

Founded date: 1994

In the high-stakes world of telecommunications, mergers can reshape the landscape. The recent decision by South Africa's Competition Tribunal to block Vodacom's acquisition of a significant stake in Maziv has sent shockwaves through the industry. This ruling is not just a legal hurdle; it’s a battle for the future of competition in the digital age.

Vodacom, a giant in mobile communications, sought to acquire up to 40% of Maziv, which owns Vumatel and Dark Fibre Africa. This deal was seen as a strategic move to bolster Vodacom's fibre capabilities. However, the tribunal’s decision reveals a deeper concern: the potential for anti-competitive behavior that could stifle innovation and harm consumers.

The tribunal's reasoning is a complex tapestry woven from various threads of competition law. At its core, the tribunal feared that Vodacom's influence over Maziv would eliminate a competitive threat. If Vodacom entered the fibre market, it could force Maziv to lower prices and improve services. This would benefit consumers, who are often caught in the crossfire of corporate maneuvers.

The tribunal identified Vodacom as a potential competitor to Maziv. The fear was that Vodacom would leverage its position to create a monopoly-like environment. By controlling a significant stake in Maziv, Vodacom could dictate terms, favoring its own interests over those of other players in the market. This could lead to a scenario where smaller internet service providers are squeezed out, reducing choices for consumers.

Vertical foreclosure was another key concern. Dark Fibre Africa holds a dominant position in the dark fibre market, with an estimated 80-90% market share. The tribunal argued that the merger would give Vodacom the ability to foreclose its mobile rivals. This means Vodacom could offer preferential terms to its own services while raising prices or degrading service quality for competitors. Such a move would create an uneven playing field, where only Vodacom could thrive.

The merger also raised alarms about anti-competitive bundling. Vodacom could bundle its mobile services with Maziv’s fibre offerings, leveraging its large subscriber base. This bundling could entrench Vodacom’s dominance, making it nearly impossible for competitors to gain a foothold. The tribunal was unconvinced by Vodacom's assurances that it would not engage in such practices. The potential for abuse of power was too great to ignore.

Public interest considerations played a role in the tribunal's decision as well. Vodacom claimed that the merger would accelerate fibre roll-out and enhance 5G deployment. However, the tribunal found these benefits were not merger-specific. Vodacom already had obligations to expand its infrastructure, regardless of the merger. This raised questions about the true motivations behind the acquisition.

The tribunal also scrutinized the remedies proposed by Vodacom. The company suggested divesting certain fibre overlaps and implementing behavioral conditions to ensure open access. However, the tribunal deemed these measures insufficient. They lacked the necessary teeth for effective monitoring and enforcement. In essence, the tribunal saw Vodacom's proposals as little more than window dressing.

The hearings revealed a stark contrast between Vodacom's portrayal of the merger and the tribunal's interpretation. Vodacom presented the deal as a lifeline for Maziv, promising to alleviate its debt burden and facilitate infrastructure investment. Yet, the tribunal viewed this as a façade. They argued that Vodacom would not be a passive investor. Instead, it would wield significant influence over Maziv’s strategic decisions.

Vodacom's status as the largest customer of Dark Fibre Africa further complicated matters. The tribunal noted that Maziv would have an incentive to cater to Vodacom's needs, potentially at the expense of its own interests. This dynamic could lead to a conflict where Maziv prioritizes Vodacom's growth over fair competition.

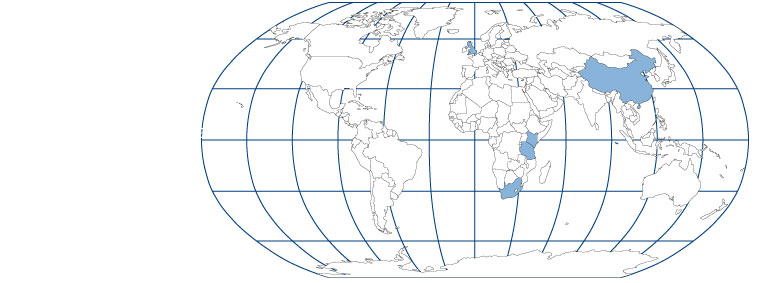

The tribunal's concerns extended to the broader implications of the merger. They recognized that Vodacom's influence could extend beyond South Africa. The company has ambitions to expand its fibre holdings across Africa. This raises the specter of Vodacom using its stake in Maziv to sway decisions that favor its interests in other markets, potentially at the cost of local competition.

As the dust settles, Vodacom is appealing the tribunal's decision. The outcome of this appeal will be closely watched, not just by the parties involved but by the entire telecommunications sector. The stakes are high. A favorable ruling for Vodacom could reshape the competitive landscape, while a sustained block could preserve a level playing field for smaller players.

In the end, this case is about more than just a merger. It’s a reflection of the ongoing struggle between corporate power and consumer rights. The tribunal's decision underscores the importance of maintaining competition in an industry that is crucial for economic growth and innovation. As the battle unfolds, one thing is clear: the future of South Africa's telecommunications market hangs in the balance.

Vodacom, a giant in mobile communications, sought to acquire up to 40% of Maziv, which owns Vumatel and Dark Fibre Africa. This deal was seen as a strategic move to bolster Vodacom's fibre capabilities. However, the tribunal’s decision reveals a deeper concern: the potential for anti-competitive behavior that could stifle innovation and harm consumers.

The tribunal's reasoning is a complex tapestry woven from various threads of competition law. At its core, the tribunal feared that Vodacom's influence over Maziv would eliminate a competitive threat. If Vodacom entered the fibre market, it could force Maziv to lower prices and improve services. This would benefit consumers, who are often caught in the crossfire of corporate maneuvers.

The tribunal identified Vodacom as a potential competitor to Maziv. The fear was that Vodacom would leverage its position to create a monopoly-like environment. By controlling a significant stake in Maziv, Vodacom could dictate terms, favoring its own interests over those of other players in the market. This could lead to a scenario where smaller internet service providers are squeezed out, reducing choices for consumers.

Vertical foreclosure was another key concern. Dark Fibre Africa holds a dominant position in the dark fibre market, with an estimated 80-90% market share. The tribunal argued that the merger would give Vodacom the ability to foreclose its mobile rivals. This means Vodacom could offer preferential terms to its own services while raising prices or degrading service quality for competitors. Such a move would create an uneven playing field, where only Vodacom could thrive.

The merger also raised alarms about anti-competitive bundling. Vodacom could bundle its mobile services with Maziv’s fibre offerings, leveraging its large subscriber base. This bundling could entrench Vodacom’s dominance, making it nearly impossible for competitors to gain a foothold. The tribunal was unconvinced by Vodacom's assurances that it would not engage in such practices. The potential for abuse of power was too great to ignore.

Public interest considerations played a role in the tribunal's decision as well. Vodacom claimed that the merger would accelerate fibre roll-out and enhance 5G deployment. However, the tribunal found these benefits were not merger-specific. Vodacom already had obligations to expand its infrastructure, regardless of the merger. This raised questions about the true motivations behind the acquisition.

The tribunal also scrutinized the remedies proposed by Vodacom. The company suggested divesting certain fibre overlaps and implementing behavioral conditions to ensure open access. However, the tribunal deemed these measures insufficient. They lacked the necessary teeth for effective monitoring and enforcement. In essence, the tribunal saw Vodacom's proposals as little more than window dressing.

The hearings revealed a stark contrast between Vodacom's portrayal of the merger and the tribunal's interpretation. Vodacom presented the deal as a lifeline for Maziv, promising to alleviate its debt burden and facilitate infrastructure investment. Yet, the tribunal viewed this as a façade. They argued that Vodacom would not be a passive investor. Instead, it would wield significant influence over Maziv’s strategic decisions.

Vodacom's status as the largest customer of Dark Fibre Africa further complicated matters. The tribunal noted that Maziv would have an incentive to cater to Vodacom's needs, potentially at the expense of its own interests. This dynamic could lead to a conflict where Maziv prioritizes Vodacom's growth over fair competition.

The tribunal's concerns extended to the broader implications of the merger. They recognized that Vodacom's influence could extend beyond South Africa. The company has ambitions to expand its fibre holdings across Africa. This raises the specter of Vodacom using its stake in Maziv to sway decisions that favor its interests in other markets, potentially at the cost of local competition.

As the dust settles, Vodacom is appealing the tribunal's decision. The outcome of this appeal will be closely watched, not just by the parties involved but by the entire telecommunications sector. The stakes are high. A favorable ruling for Vodacom could reshape the competitive landscape, while a sustained block could preserve a level playing field for smaller players.

In the end, this case is about more than just a merger. It’s a reflection of the ongoing struggle between corporate power and consumer rights. The tribunal's decision underscores the importance of maintaining competition in an industry that is crucial for economic growth and innovation. As the battle unfolds, one thing is clear: the future of South Africa's telecommunications market hangs in the balance.