Navigating the Digital Loan Landscape: Cash App vs. Alternatives in 2025

February 1, 2025, 4:27 am

Location: United States, New York

Employees: 1001-5000

Founded date: 2013

Total raised: $75K

In the fast-paced world of finance, borrowing money has transformed. Gone are the days of lengthy bank visits and piles of paperwork. Today, apps like Cash App offer a quick fix for those in need. But is it the best option? Let’s dive into the digital loan landscape of 2025.

Cash App has surged in popularity. It’s a digital wallet that allows users to send, receive, and even invest money. However, its borrowing feature is a double-edged sword. On one hand, it’s convenient. On the other, it comes with limitations that can leave borrowers in a lurch.

The borrowing process on Cash App is straightforward. Users can request small loans, typically capped at $250. This might work for minor emergencies, but what if you need more? The answer isn’t always clear. Cash App’s borrowing criteria hinge on your app activity and creditworthiness. If you don’t meet these standards, you’re out of luck.

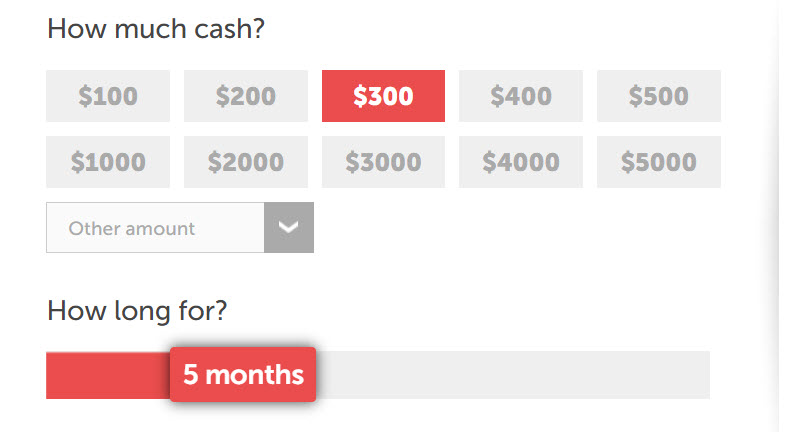

This is where alternatives like Heart Paydays and Viva Payday Loans step in. They offer a lifeline for those who don’t qualify for Cash App loans. These platforms provide higher borrowing limits and more flexible terms. For instance, Heart Paydays allows loans between $100 and $5,000. That’s a significant leap from Cash App’s meager offerings.

The application process for these alternatives is also a breeze. With Heart Paydays, you fill out a simple online form. No lengthy documentation. Just a few clicks, and you’re on your way. Once approved, funds can hit your bank account within hours. It’s like having a financial safety net at your fingertips.

But what about security? Cash App has faced scrutiny over its customer service and safety. Users have reported scams and unreliable support. The app’s automated customer service can leave borrowers feeling stranded. In contrast, platforms like Viva Payday Loans prioritize security. They connect borrowers with FCA-regulated lenders, ensuring a safer borrowing experience.

Let’s talk about repayment. Cash App loans typically require repayment within four weeks. Miss that deadline, and penalties loom. Heart Paydays and Viva Payday Loans, however, offer more breathing room. With repayment terms stretching from two months to several years, borrowers can manage their payments better. It’s like trading a sprint for a marathon.

Another critical factor is accessibility. Cash App’s borrowing feature isn’t available to everyone. If you’re not a frequent user or have a low credit score, you might find yourself shut out. Heart Paydays and Viva Payday Loans, on the other hand, cater to a broader audience. They’re designed to help those who might struggle with traditional lending criteria.

So, what’s the verdict? Cash App is a convenient tool for quick cash needs. But its limitations can be a stumbling block. If you’re looking for a more robust solution, consider alternatives like Heart Paydays or Viva Payday Loans. They offer higher limits, flexible repayment options, and a more secure borrowing experience.

In 2025, the digital loan landscape is evolving. Borrowers have choices. Cash App may be the first name that comes to mind, but it’s not the only player in the game. As you navigate your financial needs, weigh your options carefully. The right choice can make all the difference.

In conclusion, the borrowing experience in 2025 is a mixed bag. Cash App shines in convenience but falters in flexibility and security. Alternatives like Heart Paydays and Viva Payday Loans provide a more comprehensive safety net. They cater to a wider audience and offer better terms.

As you explore your borrowing options, remember: the best choice is the one that fits your needs. Whether you opt for Cash App or an alternative, ensure you understand the terms. Knowledge is power in the world of finance. Make informed decisions, and you’ll navigate the digital loan landscape with confidence.

In this age of technology, financial solutions are just a tap away. But tread carefully. The right app can be a lifeline, while the wrong one can lead to pitfalls. Choose wisely, and may your financial journey be smooth and secure.

Cash App has surged in popularity. It’s a digital wallet that allows users to send, receive, and even invest money. However, its borrowing feature is a double-edged sword. On one hand, it’s convenient. On the other, it comes with limitations that can leave borrowers in a lurch.

The borrowing process on Cash App is straightforward. Users can request small loans, typically capped at $250. This might work for minor emergencies, but what if you need more? The answer isn’t always clear. Cash App’s borrowing criteria hinge on your app activity and creditworthiness. If you don’t meet these standards, you’re out of luck.

This is where alternatives like Heart Paydays and Viva Payday Loans step in. They offer a lifeline for those who don’t qualify for Cash App loans. These platforms provide higher borrowing limits and more flexible terms. For instance, Heart Paydays allows loans between $100 and $5,000. That’s a significant leap from Cash App’s meager offerings.

The application process for these alternatives is also a breeze. With Heart Paydays, you fill out a simple online form. No lengthy documentation. Just a few clicks, and you’re on your way. Once approved, funds can hit your bank account within hours. It’s like having a financial safety net at your fingertips.

But what about security? Cash App has faced scrutiny over its customer service and safety. Users have reported scams and unreliable support. The app’s automated customer service can leave borrowers feeling stranded. In contrast, platforms like Viva Payday Loans prioritize security. They connect borrowers with FCA-regulated lenders, ensuring a safer borrowing experience.

Let’s talk about repayment. Cash App loans typically require repayment within four weeks. Miss that deadline, and penalties loom. Heart Paydays and Viva Payday Loans, however, offer more breathing room. With repayment terms stretching from two months to several years, borrowers can manage their payments better. It’s like trading a sprint for a marathon.

Another critical factor is accessibility. Cash App’s borrowing feature isn’t available to everyone. If you’re not a frequent user or have a low credit score, you might find yourself shut out. Heart Paydays and Viva Payday Loans, on the other hand, cater to a broader audience. They’re designed to help those who might struggle with traditional lending criteria.

So, what’s the verdict? Cash App is a convenient tool for quick cash needs. But its limitations can be a stumbling block. If you’re looking for a more robust solution, consider alternatives like Heart Paydays or Viva Payday Loans. They offer higher limits, flexible repayment options, and a more secure borrowing experience.

In 2025, the digital loan landscape is evolving. Borrowers have choices. Cash App may be the first name that comes to mind, but it’s not the only player in the game. As you navigate your financial needs, weigh your options carefully. The right choice can make all the difference.

In conclusion, the borrowing experience in 2025 is a mixed bag. Cash App shines in convenience but falters in flexibility and security. Alternatives like Heart Paydays and Viva Payday Loans provide a more comprehensive safety net. They cater to a wider audience and offer better terms.

As you explore your borrowing options, remember: the best choice is the one that fits your needs. Whether you opt for Cash App or an alternative, ensure you understand the terms. Knowledge is power in the world of finance. Make informed decisions, and you’ll navigate the digital loan landscape with confidence.

In this age of technology, financial solutions are just a tap away. But tread carefully. The right app can be a lifeline, while the wrong one can lead to pitfalls. Choose wisely, and may your financial journey be smooth and secure.