Kennet's Bold Move: €266 Million Fund for B2B SaaS Growth

July 30, 2024, 3:33 am

Location: United Kingdom, England, Sheffield

Employees: 11-50

Founded date: 2018

In a world where financial landscapes shift like sand, Kennet Partners has anchored itself firmly with the launch of its largest fund to date. The transatlantic growth equity investor has successfully raised €266 million for Kennet VI, a fund designed to target high-growth B2B SaaS companies across Europe. This strategic move comes at a time when many investors are treading cautiously, making Kennet's achievement all the more noteworthy.

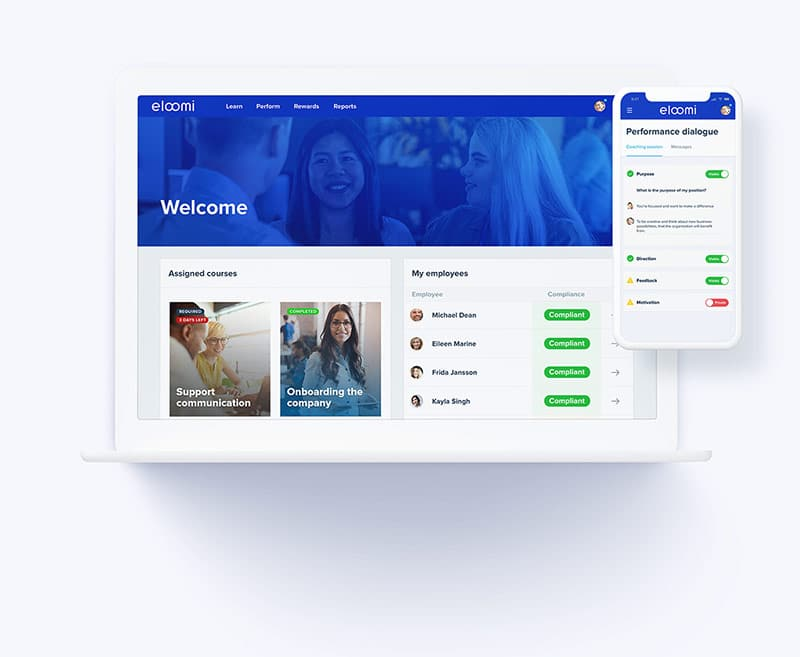

Kennet VI is not just another fund; it’s a testament to the firm’s 25 years of experience and a track record that has weathered multiple market cycles. The firm has consistently delivered impressive exits, with recent successes like Eloomi, which generated a 3.1x cash multiple in January 2024. Other notable exits include Nuxeo (5x), Dext (3.8x), and CrossBorder Solutions (6.4x). These figures are not mere numbers; they represent the lifeblood of Kennet’s investment philosophy.

Kennet’s focus is laser-sharp. The firm exclusively invests in established, founder-owned B2B SaaS companies that are either highly capital efficient or fully bootstrapped. This means they have built their businesses without relying heavily on external funding. For many of these companies, Kennet’s investment is the first external capital they receive. This funding is crucial. It’s not just about money; it’s about scaling operations, expanding internationally, and building world-class management teams.

The current market sentiment has shifted. The era of “growth at any cost” is fading. Investors are now looking for sustainable growth models. Kennet’s conservative strategy resonates in this environment. The firm emphasizes a risk-balanced approach, providing investors with the potential for growth while maintaining a low failure rate. This is a refreshing change in a market often driven by hype and speculation.

Kennet’s relationship with its founders is built on trust. The firm understands that many of these entrepreneurs have never taken external investment before. They need to feel secure in their choice of partner. Kennet’s reputation for fairness and integrity has made it a preferred choice for many founders. This long-term partnership model is a cornerstone of Kennet’s strategy. It’s not just about the money; it’s about nurturing relationships that foster growth.

The partnership with Edmond de Rothschild Private Equity has been pivotal. Since 2017, this collaboration has provided a solid foundation for Kennet VI. Edmond de Rothschild is a cornerstone investor in the fund, giving its global client base priority access. Other significant commitments have come from British Patient Capital, Federated Hermes Private Equity, and Bpifrance. This diverse backing underscores the confidence investors have in Kennet’s strategic vision.

Kennet VI is poised to capitalize on the growing importance of B2B software. In today’s economy, technology is the engine room driving innovation across sectors. Companies that leverage cutting-edge tech solutions are not just surviving; they are thriving. Kennet’s focus on capital-efficient businesses positions it at the forefront of this transformation.

The fund’s deployment has already begun, with investments in companies like Screendragon in Ireland and Fluid Topics in France. These investments are not random; they are carefully selected opportunities that align with Kennet’s investment thesis. Each company represents a potential catalyst for growth, not just for Kennet but for the broader economy.

As the global market continues to evolve, the demand for innovative technology solutions will only increase. Companies that can adapt and scale will be the ones that succeed. Kennet VI is designed to identify and support these companies. The fund’s strategy is clear: invest in businesses that are not just looking for quick wins but are committed to long-term growth and sustainability.

In conclusion, Kennet’s €266 million fund is more than just a financial milestone. It’s a strategic response to a changing market landscape. By focusing on capital-efficient, founder-owned B2B SaaS companies, Kennet is positioning itself as a leader in the next wave of technological innovation. The firm’s commitment to building trusted partnerships with entrepreneurs will ensure that it remains at the forefront of this dynamic sector. As the dust settles on this fundraising effort, one thing is clear: Kennet is ready to ride the wave of growth in the B2B SaaS space, and it’s doing so with a steady hand and a clear vision.

Kennet VI is not just another fund; it’s a testament to the firm’s 25 years of experience and a track record that has weathered multiple market cycles. The firm has consistently delivered impressive exits, with recent successes like Eloomi, which generated a 3.1x cash multiple in January 2024. Other notable exits include Nuxeo (5x), Dext (3.8x), and CrossBorder Solutions (6.4x). These figures are not mere numbers; they represent the lifeblood of Kennet’s investment philosophy.

Kennet’s focus is laser-sharp. The firm exclusively invests in established, founder-owned B2B SaaS companies that are either highly capital efficient or fully bootstrapped. This means they have built their businesses without relying heavily on external funding. For many of these companies, Kennet’s investment is the first external capital they receive. This funding is crucial. It’s not just about money; it’s about scaling operations, expanding internationally, and building world-class management teams.

The current market sentiment has shifted. The era of “growth at any cost” is fading. Investors are now looking for sustainable growth models. Kennet’s conservative strategy resonates in this environment. The firm emphasizes a risk-balanced approach, providing investors with the potential for growth while maintaining a low failure rate. This is a refreshing change in a market often driven by hype and speculation.

Kennet’s relationship with its founders is built on trust. The firm understands that many of these entrepreneurs have never taken external investment before. They need to feel secure in their choice of partner. Kennet’s reputation for fairness and integrity has made it a preferred choice for many founders. This long-term partnership model is a cornerstone of Kennet’s strategy. It’s not just about the money; it’s about nurturing relationships that foster growth.

The partnership with Edmond de Rothschild Private Equity has been pivotal. Since 2017, this collaboration has provided a solid foundation for Kennet VI. Edmond de Rothschild is a cornerstone investor in the fund, giving its global client base priority access. Other significant commitments have come from British Patient Capital, Federated Hermes Private Equity, and Bpifrance. This diverse backing underscores the confidence investors have in Kennet’s strategic vision.

Kennet VI is poised to capitalize on the growing importance of B2B software. In today’s economy, technology is the engine room driving innovation across sectors. Companies that leverage cutting-edge tech solutions are not just surviving; they are thriving. Kennet’s focus on capital-efficient businesses positions it at the forefront of this transformation.

The fund’s deployment has already begun, with investments in companies like Screendragon in Ireland and Fluid Topics in France. These investments are not random; they are carefully selected opportunities that align with Kennet’s investment thesis. Each company represents a potential catalyst for growth, not just for Kennet but for the broader economy.

As the global market continues to evolve, the demand for innovative technology solutions will only increase. Companies that can adapt and scale will be the ones that succeed. Kennet VI is designed to identify and support these companies. The fund’s strategy is clear: invest in businesses that are not just looking for quick wins but are committed to long-term growth and sustainability.

In conclusion, Kennet’s €266 million fund is more than just a financial milestone. It’s a strategic response to a changing market landscape. By focusing on capital-efficient, founder-owned B2B SaaS companies, Kennet is positioning itself as a leader in the next wave of technological innovation. The firm’s commitment to building trusted partnerships with entrepreneurs will ensure that it remains at the forefront of this dynamic sector. As the dust settles on this fundraising effort, one thing is clear: Kennet is ready to ride the wave of growth in the B2B SaaS space, and it’s doing so with a steady hand and a clear vision.